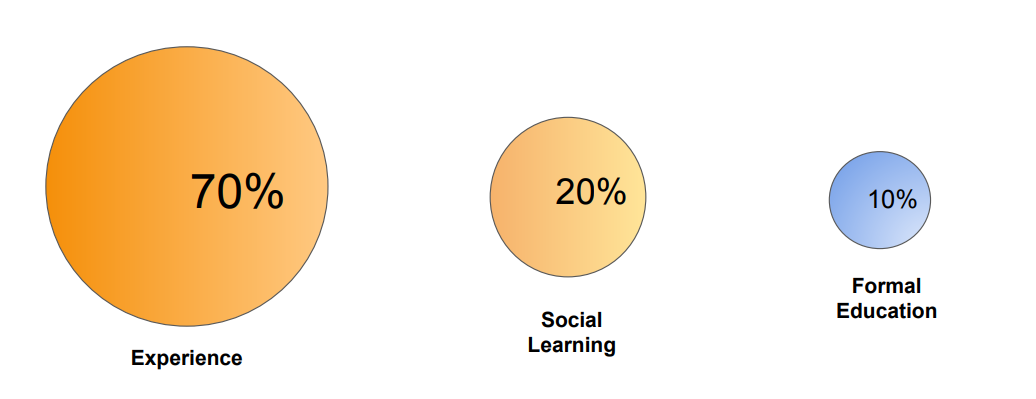

The world of accounting goes beyond textbooks; it's about applying what's learned in a real, practical setting. A study highlighted how hands-on experience complements theoretical knowledge, making learning well-rounded and meaningful1. And the job outlook is promising too! There’s a projected 4% growth in jobs for accountants and auditors from 2022 to 2032, indicating that practical skills are in demand.

Enter MonsoonSIM—it offers a unique way to dive into interactive accounting business simulations. Here, learning about accounting is not just about going through theories but experiencing them in simulated business scenarios. MonsoonSIM makes learning engaging and relevant, preparing aspiring accountants for the practical challenges ahead.

MonsoonSIM offers a unique way to dive into interactive accounting business simulations. MonsoonSIM makes learning engaging and relevant, preparing aspiring accountants for the practical challenges ahead.

MonsoonSIM's interactive platform takes users through the Experiential Learning Cycle, enhancing the concrete experience of financial literacy

Introduction: Why Accounting Education Needs a Revamp

Context: The Limitations of Traditional Accounting Education

For years, accounting education has relied heavily on textbooks and theoretical concepts, focusing on rote learning and memorization. Students are typically taught the mechanics of financial statements, tax laws, and auditing standards through lectures and textbook exercises. While this provides a solid foundation in accounting principles, it often falls short of preparing students for the complexities of real-world business environments.

The gap between theory and practice becomes evident when students enter the workforce. They may understand the technical aspects of preparing balance sheets and income statements but lack the practical experience of making critical financial decisions, analyzing live data, or handling unforeseen financial challenges. This disconnect between classroom learning and workplace demands highlights a significant issue in traditional accounting education: students are not equipped with the hands-on skills they need to excel in modern business environments.

Why MonsoonSIM: Bridging the Gap with Experiential Learning

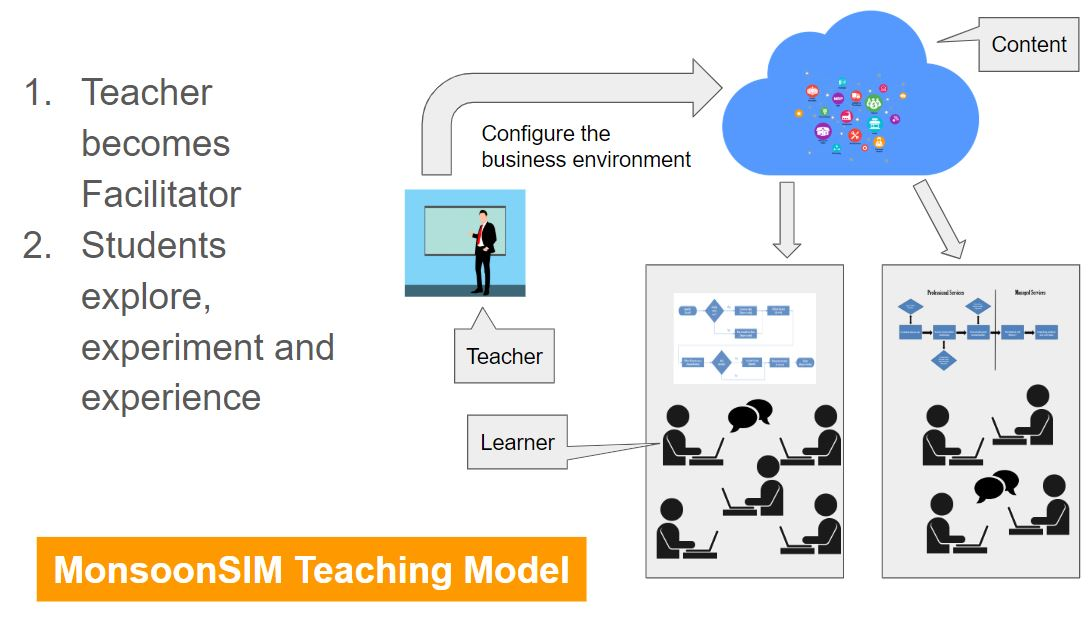

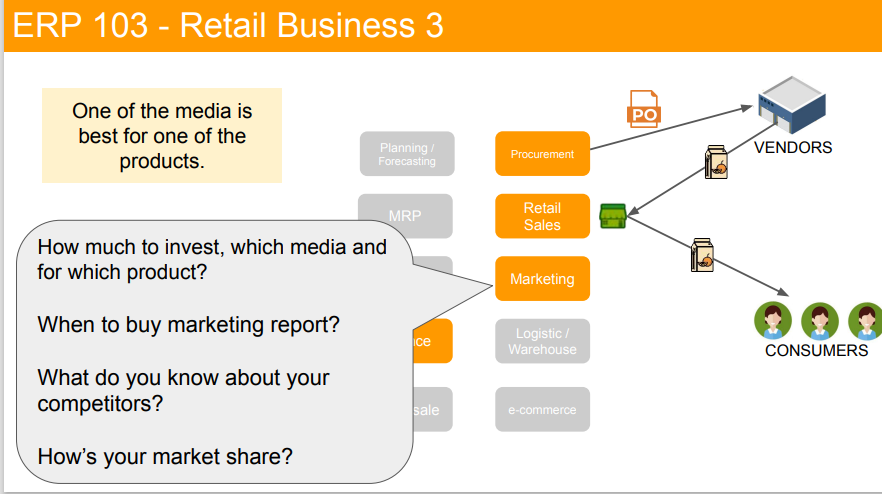

MonsoonSIM revolutionizes accounting education by offering an experiential learning platform that integrates real-world scenarios. Unlike traditional methods, students manage accounting tasks in a simulated business environment, assuming roles like Chief Financial Officer or Accountant. They make strategic decisions that directly impact their virtual company’s financial performance.

This hands-on approach allows students to experience the outcomes of their financial choices in real-time, developing critical skills such as cash flow management, budgeting, and data interpretation. MonsoonSIM not only reinforces theoretical concepts but also fosters practical, decision-making abilities essential for today’s accountants. By shifting from passive learning to active participation, MonsoonSIM ensures students are prepared for real-world success.

An In-Depth Exploration of the MonsoonSIM Finance Module

The MonsoonSIM Finance Module offers an extensive and configurable educational environment suitable for teaching various aspects of financial management. For instructors or teachers who are seeking an effective way to engage students in financial subjects, this module provides an array of options to tailor the learning experience. For more information about MonsoonSIM for business find our home page here.

Learn about transforming corporate training into a growth catalyst with MonsoonSIM

Adapting the Finance Module for Accounting Teaching

- Configurable Accounting Methods: Teachers can choose to focus on either Cash or Accrual accounting methods based on the course requirements.

- Variable Loan Terms: In the loan management section, educators have the freedom to adjust the terms and interest rates of loans. This offers students a chance to understand the implications of different repayment structures in a safe, simulated environment.

- Business Intelligence Customization: The module's Financial Intelligence feature can be configured to display specific key metrics and ratios that the instructor wishes to emphasize.

Explore the Revolutionary Approach to Accounting Education with MonsoonSIM: Uncover Innovative Strategies and Practical Insights for Making Accounting Engaging and Accessible

For a short overview of MonsoonSIM's finance module have a look at this video:

Monsoon Sim provides hands-on experience in managing financial affairs, starting with a set capital, and optionally introducing borrowing options through a simulated banking facility.

MonsoonSIM Use Cases: Educational Case Studies in Accounting

Deakin University

At Deakin University, MonsoonSIM was integrated into undergraduate capstone units, transforming theoretical knowledge into practical skills. This approach allowed students to experience real-world accounting scenarios in a controlled environment.

Key Highlights:

- Practical Financial Management: Students managed virtual businesses, handling real-world accounting tasks such as financial statement preparation, budget management, and financial analysis.

- Scenario-Based Learning: MonsoonSIM provided scenarios such as cash flow crises, investment decisions, and loan management, reflecting real-world financial challenges.

- Employability Skills: By engaging in these scenarios, students developed competencies in teamwork, problem-solving, and financial decision-making, directly applicable to professional accounting roles.

For a full overview, visit the Deakin University case study.

Michigan State University

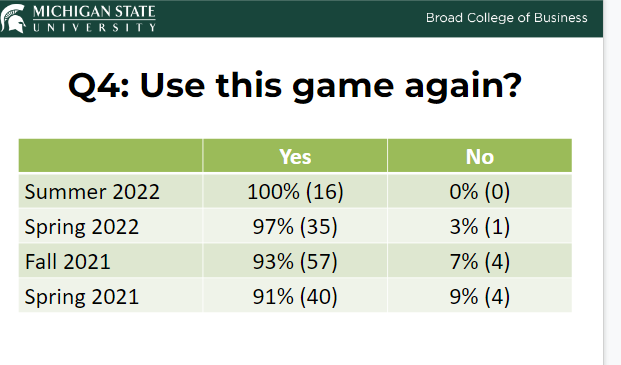

Michigan State University (MSU) showcases how MonsoonSIM's simulation environment bridges the gap between academic theory and real-world accounting practice. The platform enabled students to apply their learning in dynamic business scenarios.

Key Highlights:

- Dynamic Financial Scenarios: Students engaged in simulations that required them to manage financial operations, including journal entries, balance sheets, and profit and loss statements, mirroring tasks they will face in the real world.

- Risk Management and Strategic Planning: MonsoonSIM allowed students to experience the consequences of financial decisions, such as overspending and managing delinquent payouts, teaching them crucial risk management skills.

- Adaptability to Real-World Changes: The simulation included real-world elements like market fluctuations and regulatory changes, preparing students to adapt to dynamic business environments.

For more details, explore the Michigan State University case study.

The Intersection of Theory and Real-World Application

MonsoonSIM takes accounting beyond the textbooks and classrooms by offering a comprehensive simulation that prepares you for real-world financial management. This isn't just about memorizing accounting principles; it's about applying them in various business contexts to solve complex challenges.

Hands-On Experience with Cash and Accrual Accounting

Here, players can record transactions through journal entries, maintain balance sheets, and generate profit and loss statements. This practical approach ensures that users not only understand the theoretical underpinnings of accounting but also know how to apply them in an actual business environment.

Finance Module In Detail

Explore the comprehensive simulation experience of financial management with our Finance (FIN) Module article, offering insights into money management, accounting practices, and financial analysis within a business context.

Delving into Financial Reports Aligned with GAAP

Financial reporting, rooted in GAAP (Generally Accepted Accounting Practice), is pivotal for effective business management. MonsoonSIM integrates this principle, offering a real-world experience:

- Interactive Financial Reports: Users generate key reports like profit and loss statements and balance sheets. With real-time feedback, they witness the direct effects of their business decisions.

- Analysis Skills: MonsoonSIM aids in not just report generation, but also its interpretation, enabling students to derive actionable insights for short and long-term strategies.

- Average Costing: The simulation introduces average costing, elucidating inventory valuation and its relevance in financial reports.

- Transparency & Relevance: Adherence to GAAP fosters credibility in reporting. With global businesses adopting GAAP, MonsoonSIM readies students for international finance and business roles, emphasizing both theory and its real-world application.

Explore Critical Thinking with MonsoonSIM: Dive deeper into how MonsoonSIM fosters essential skills like critical thinking and problem-solving, crucial for mastering financial literacy. Check out "MonsoonSIM's Role in Critical Thinking and Problem-Solving" to understand how this innovative platform shapes strategic thinking in financial contexts.

In essence, MonsoonSIM offers a streamlined, hands-on experience in GAAP-aligned financial reporting, priming students for impactful careers in the business sector.

Dive deeper into how MonsoonSIM fosters essential skills like critical thinking and problem-solving, crucial for mastering financial literacy. Check out "MonsoonSIM's Role in Critical Thinking and Problem-Solving" to understand how this innovative platform shapes strategic thinking in financial contexts.

Master Real-time Financial Risks:

MonsoonSIM provides a hands-on financial experience with real outcomes. Using features like "Delinquent Payout", players learn to manage funds. Overspending leads to tangible setbacks, like undelivered goods or canceled orders, simulating real business challenges.

Crack the Code on Creditworthiness:

MonsoonSIM's module unravels the intricacies of financial trust. Players' financial strategies determine their credit ratings, ranging from Unrated to AAA. A hands-on lesson on the power and significance of sustaining robust financial health in business.

For a full overview of all you can configure as a teacher you can read our article Business Simulations made simple

Uncover the transformative impact of MonsoonSIM on building a wide array of business skills, including financial literacy. Read "Enhancing Business Skills with MonsoonSIM - A Skill-Building Revolution" to see how MonsoonSIM revolutionizes the way professionals and students learn critical business concepts.

Integration with Curriculum: Enhancing Financial Education with MonsoonSIM

MonsoonSIM provides a dynamic platform for integrating experiential learning into financial education curricula at academic institutions and within corporate training programs. Its comprehensive set of modules and configurable scenarios make it a versatile tool suitable for learners at various educational levels—from high school students to business professionals in corporate settings.

| Modules | Description | Education Level |

| Finance Module | Focus on cash flow management, understanding financial statements, and budgeting. | Suitable for all levels, from high school to professional. |

| Procurement and Retail Modules | Explore the impact on financial health through supply chain and retail management simulations. | Ideal for understanding sector-specific financial health. |

| MRP and Production Modules | Connect production planning and inventory management to financial metrics such as cost of goods sold. | Useful for linking operational decisions to financial outcomes. |

| Customizable Scenarios | Tailor scenarios to match specific learning objectives, such as financial recovery or growth strategies. Difficulty levels adjustable from basic to complex. | Adaptable to learner's educational level and experience. |

| Short-term Financial Management | Emphasis on managing working capital and making short-term financing decisions. | High School/Undergraduate focus on basic financial management. |

| Long-term Strategic Planning | Focus on long-term financial planning, including investment decisions and financial risk management. | Graduate/Professional level with strategic financial focus. |

| Interdisciplinary Integration | Demonstrate the interconnectedness of finance with other business functions like HR and Marketing. | Demonstrates holistic business understanding. |

| Assessment and Feedback | Real-time Feedback through live data analytics. Assessment Tools utilize built-in tools for performance evaluation. | Provides immediate insights and comprehensive evaluation. |

| Implementation and Support | Training for Educators, Resource Materials including guides and tutorial videos, Customer Support for simulation design and implementation. | Supports effective integration and use of MonsoonSIM in educational settings. |

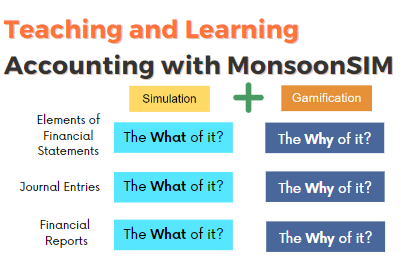

Accounting Teaching Gamified with MonsoonSIM

MonsoonSIM transforms traditional accounting education into an engaging and immersive experience by incorporating various game elements that make learning both interactive and practical. Here’s a look at how MonsoonSIM gamifies accounting teaching to enhance student engagement and understanding:

Game Elements in MonsoonSIM’s Accounting Module

Dynamic Financial Scenarios:

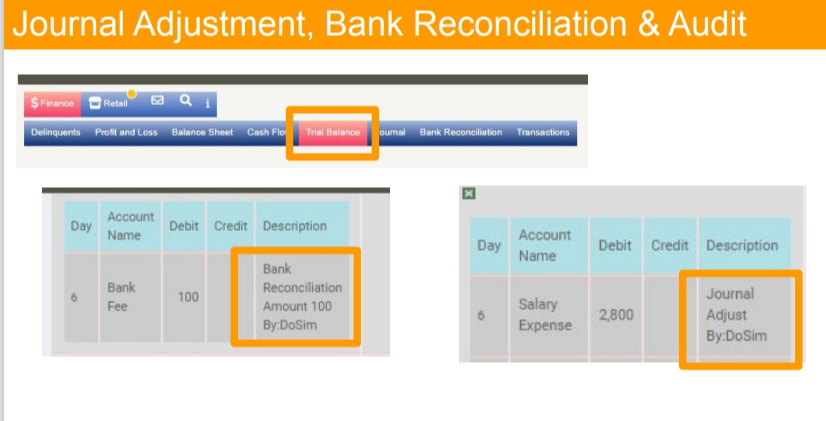

- Journal Entries and Audit Trails: MonsoonSIM includes detailed functionalities for recording journal entries and maintaining audit trails, providing students with a realistic experience of managing financial records and understanding the implications of each transaction on the business’s financial health.

- Bank Reconciliation: Enhanced bank reconciliation features allow students to match their business’s financial records with bank statements, ensuring accuracy and understanding discrepancies. This process is crucial for developing a meticulous approach to financial management.

Configurable Accounting Methods:

- Cash vs. Accrual Accounting: Educators can choose between cash and accrual accounting methods based on course requirements, providing flexibility in teaching different accounting practices. This customization helps students understand the differences and applications of each method in various business contexts.

- Variable Loan Terms: Instructors can adjust loan terms and interest rates, offering students insights into the impact of different repayment structures on a business’s financial stability.

Business Intelligence Customization:

- Financial Intelligence Feature: MonsoonSIM allows customization of financial metrics and ratios that the instructor wishes to emphasize, helping students focus on key areas of financial analysis and performance evaluation. This feature supports the development of critical thinking and analytical skills.

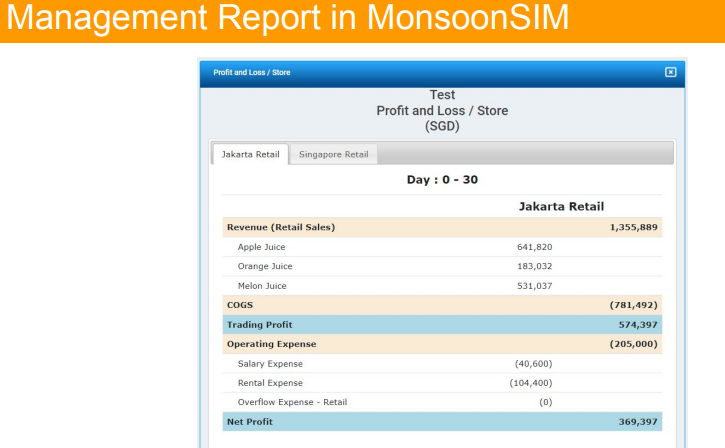

Engage Your Students with Real-Time Financial Reporting: The Profit & Loss Statement

The Profit and Loss (P&L) statement, or income statement, is a crucial financial document that summarizes a company’s revenues, costs, and expenses over a specific period. It shows a company’s profitability and financial health.

In MonsoonSIM, you can:

- Track financial performance in real-time

- Make decisions on revenue and cost management

- See immediate impacts on the P&L statement

- Analyze and interpret financial data

This hands-on approach helps you gain practical skills in financial management and strategic decision-making.

MonsoonSIM also covers other key financial statements:

- Balance Sheet: Understand assets, liabilities, and equity.

- Cash Flow Statement: Manage cash inflows and outflows.

Experience comprehensive financial reporting and analysis in an interactive and engaging way.

Engagement Through Competition:

- MonsoonSIM Annual Competition: The MonsoonSIM Enterprise Resource Management Competition (MERMC) encourages students to apply their learning in a competitive environment, enhancing their strategic thinking, teamwork, and problem-solving skills. This competition simulates real-world business environments and challenges students to outperform their peers.

Integrated Learning Modules:

- Comprehensive Coverage: MonsoonSIM integrates various business functions such as finance, procurement, production, and marketing into the simulation. This holistic approach ensures that students understand the interconnectedness of different business departments and how financial decisions impact overall business operations.

- Tailored Scenarios: Educators can create and save customized courses that align with specific learning objectives, adjusting the complexity and focus areas to suit different educational levels and goals. This adaptability makes MonsoonSIM suitable for a wide range of learners, from high school students to business professionals.

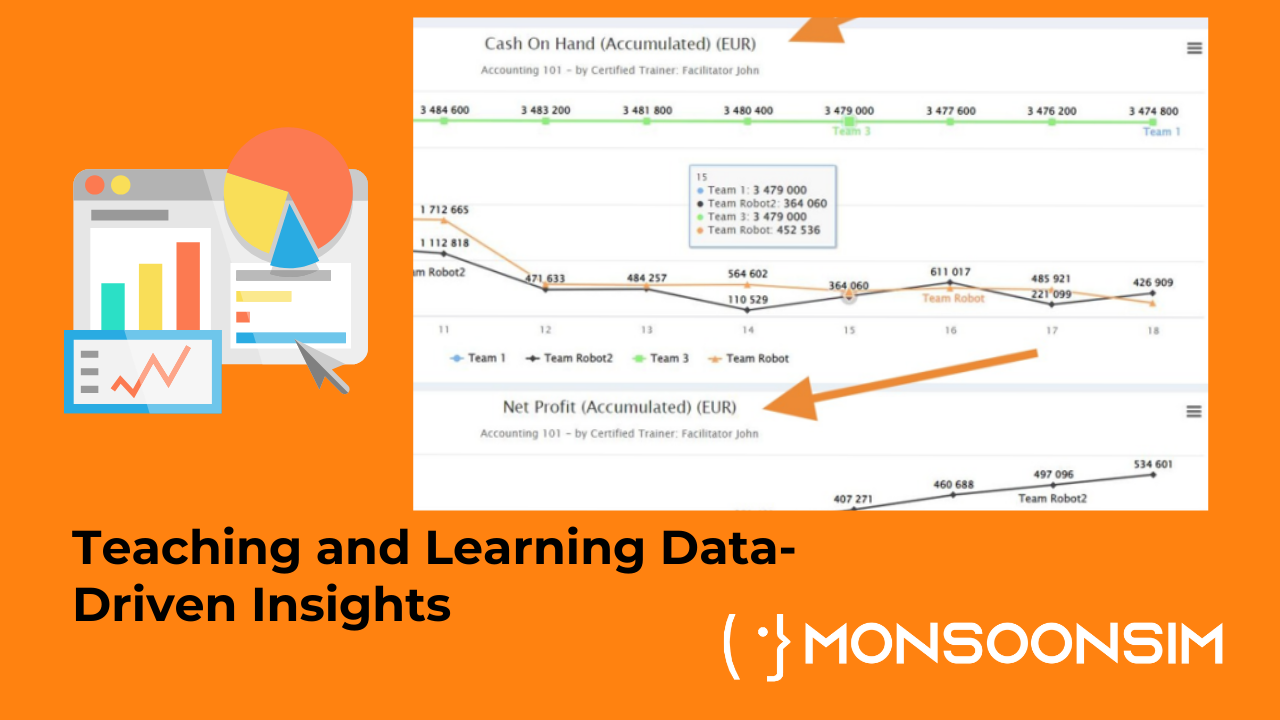

Real-Time Feedback and Assessment:

- Live Data Analytics: MonsoonSIM provides real-time feedback through live data analytics, allowing students to see the immediate impact of their decisions. This feature supports continuous learning and improvement by helping students understand the consequences of their actions in a simulated environment.

- Performance Evaluation: Built-in assessment tools enable educators to evaluate students’ performance effectively, providing insights into their strengths and areas for improvement. This comprehensive evaluation process ensures that students receive constructive feedback that enhances their learning experience.

Engaging in MonsoonSIM: Building Business Acumen through Interactive Accounting

In MonsoonSIM, learners immerse themselves in a virtual business landscape where they make strategic decisions to successfully operate a company. The game simulates real-world business operations, challenging learners to apply accounting and business concepts dynamically and competitively. Here’s what learners experience in the game:

Buying and Selling Goods:

- Inventory Management: Decide on product purchases, restock times, and inventory levels, directly linking to managing inventory costs and optimizing cash flow.

- Sales and Revenue Generation: Set competitive prices, run promotions, and implement sales strategies while recording sales data accurately to understand revenue recognition and financial performance.

Forecasting Demand and Planning Production:

- Demand Forecasting: Analyze market data and economic indicators to predict product demand, informing decisions on inventory and production planning.

- Production Planning: Manage production schedules, calculate costs, and allocate resources effectively, integrating cost accounting and budgeting practices.

Managing Financial Operations:

- Budgeting and Cash Flow Management: Create budgets, allocate resources, and monitor cash flow, ensuring smooth business operations and financial stability.

- Financial Reporting: Prepare and analyze real-time financial statements, including income statements and balance sheets, to assess business health.

Optimizing Pricing and Cost Management:

- Pricing Strategy: Develop pricing tactics based on market conditions, competitor analysis, and cost structures to maintain profitability.

- Cost Control: Make decisions to reduce costs while maintaining quality, learning essential cost accounting and operational efficiency techniques.

Navigating Market Dynamics and Competition:

- Market Analysis: Monitor market trends, consumer behavior, and competitor strategies, adapting business approaches to remain competitive.

- Competitive Strategy: Formulate strategies to outperform competitors, enhancing strategic management and market positioning skills.

Engaging in Financial Risk Management:

- Risk Assessment and Mitigation: Identify and manage financial risks such as credit and market risks, developing risk mitigation strategies.

- Loan and Credit Management: Manage loans and credit, understanding interest rates, creditworthiness, and debt impact on financial health.

Facilitating Collaborative Accounting Learning through MonsoonSIM

MonsoonSIM offers a unique approach to fostering collaborative learning among accounting students. Unlike traditional, lecture-based education, this platform requires students to work in teams, simulating real-world business environments where collaboration is crucial. Each team member can be assigned roles such as Chief Financial Officer (CFO) or Controller, necessitating the integration of various accounting and financial functions to achieve common goals. This structure not only enhances individual accountability but also ensures that students learn the importance of coordination and collaboration in achieving financial accuracy and compliance.

Team Roles and Responsibilities in MonsoonSIM Accounting Simulation:

Role and Responsibilities

| CFO | Overall financial strategy, decision making, and financial leadership |

| Controller | Managing financial reporting, internal controls, and compliance |

| Accountant | Handling day-to-day transactions, bookkeeping, and financial statement preparation |

| Auditor | Conducting audits, ensuring accuracy, and verifying compliance with accounting standards |

| Budget Analyst | Financial planning, budgeting, and variance analysis |

By adopting such a dynamic learning platform, educators can bridge the gap between theoretical knowledge and practical accounting skills, preparing students for the collaborative nature of modern accounting environments.

Integrating MonsoonSIM into Financial Literacy Education

MonsoonSIM's adaptability makes it an excellent tool for enhancing financial literacy. Unlike traditional business simulation games that focus on isolated business processes, MonsoonSIM offers an integrated approach that reflects the interconnectedness of real-world business functions. This integrated framework allows educators to design comprehensive learning modules that cover various financial disciplines within a single platform.

For example, educators can create a curriculum that walks students through a complete financial cycle:

| Discipline | Topic Covered | MonsoonSIM Modules Involved |

| Financial Planning | Budgeting, Cash Flow Management, Investment Analysis | Financial Accounting, Cash Management |

| Financial Reporting | Balance Sheets, Income Statements, Financial Ratios | Financial Reporting, Performance Evaluation |

| Risk Management | Identifying and Mitigating Financial Risks | Risk Management, Financial Forecasting |

| Investment Analysis | Market Research, Portfolio Management | Market Research, Investment Planning |

Such holistic learning experiences can help students understand how decisions in one area affect other parts of a business, thereby preparing them for roles that require comprehensive financial expertise.

Focus on Interactive Scenarios

MonsoonSIM’s interactive scenarios are at the heart of its gamified approach to accounting education. These scenarios immerse students in realistic business environments where they can apply theoretical knowledge to practical situations:

- Financial Crisis Management: Students experience cash flow crises and learn to manage delinquent payments, teaching them essential skills in financial risk management and decision-making.

- Market Fluctuations: The simulation includes dynamic elements such as market fluctuations and regulatory changes, preparing students to adapt to real-world business environments.

- Role-Playing: Participants assume specific roles within the simulated company, like CEO or CFO, enhancing immersion and allowing them to experience the nuances of managing a business.

- Team Collaboration: The simulation promotes teamwork, requiring players to collaborate on decision-making and strategy development, mirroring the collaborative nature of multiplayer online games.

Exciting Accounting Enhancements in MonsoonSIM V12: Journal Entries, Audit Trails, and More

MonsoonSIM V12 introduces several significant updates that enhance the learning experience in accounting, specifically focusing on budget management, journal audits, and bank reconciliation:

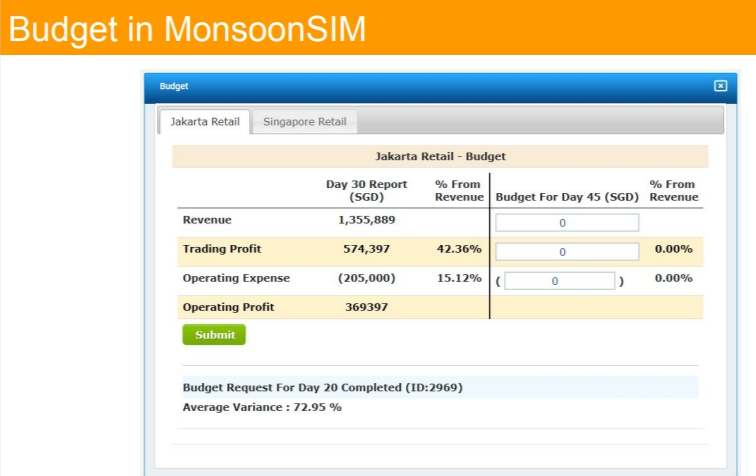

Budget Management Reports for Each Store:

- Detailed Budget Management: The update provides comprehensive budget management reports for each store. This feature allows users to monitor and manage budgets effectively across various locations, helping students understand how budgeting impacts financial performance and decision-making within a business context.

Journal Entries and Audit Trails:

- Enhanced Journal Entries: The latest update includes improved functionalities for recording and managing journal entries. Students can now engage in a more realistic process of recording transactions, ensuring accurate financial records, and understanding the implications of each entry on the business's overall financial health.

- Comprehensive Audit Trails: MonsoonSIM V12 features detailed audit trails that track every financial transaction within the simulation. This enables students to trace transactions back to their origins, providing a clear and transparent view of the accounting processes, crucial for understanding internal controls and financial accountability.

Bank Reconciliation:

- Bank Reconciliation Processes: The update introduces enhanced bank reconciliation features, allowing students to match their business’s financial records with their bank statements. This feature is vital for ensuring the accuracy of financial data, identifying discrepancies, and understanding the reconciliation process.

Management Reports for Each Store:

- Store-Level Financial Reporting: MonsoonSIM V12 includes detailed management reports for each store. These reports provide insights into the financial performance of individual stores, helping students analyze revenue, expenses, and profitability at a granular level. This enhances their understanding of how different stores contribute to the overall financial health of the business.

These updates make MonsoonSIM V12 an even more powerful tool for teaching and learning accounting, providing enhanced support, streamlined setup, and improved monitoring capabilities to ensure a comprehensive and engaging educational experience. For more details on how these features can be integrated into your curriculum, explore our article on Business Simulations Made Simple.

Enhanced Financial Skill Development through Real-Time Data Analytics

MonsoonSIM offers a unique advantage by emphasizing real-time data analytics, which is increasingly crucial in modern financial environments. The simulation provides continuous data streams that teams must analyze to make informed decisions, thus enhancing students' analytical and decision-making skills. In traditional classroom settings, the emphasis is often on theoretical knowledge; however, MonsoonSIM bridges this gap by requiring students to apply their learning in dynamic, simulated environments.

Students can engage in scenario-based exercises that demand quick thinking and proficiency in data interpretation:

| Skill Developed | Real-World Application | MonsoonSIM Feature |

| Data Interpretation | Understanding market trends, financial statements | Financial Analytics, Market Research |

| Decision Making | Strategic financial planning, problem-solving | Real-Time Financial Environment, Scenario Analysis |

Critical Thinking

| Evaluating financial risks and opportunities | Risk Management, Financial Forecasting |

| Collaborative Skills | Team-based financial strategy formulation | Multi-User Collaboration, Role-Based Scenarios |

By integrating these features into the educational curriculum, MonsoonSIM not only enhances theoretical knowledge but also equips students with practical financial skills highly valued by employers. This makes it a valuable asset for educators aiming to improve financial literacy and produce industry-ready graduates.

Getting Started with MonsoonSIM

Embarking on the journey to integrate MonsoonSIM into your accounting curriculum is an exciting venture that promises a rich, interactive learning experience for your students. Here's a step-by-step guide to get you started:

Consider how the simulation aligns with your course objectives and the practical skills you aim to impart to your students.

Explore the Revolutionary Approach to Accounting Education with MonsoonSIM: Uncover Innovative Strategies and Practical Insights for Making Accounting Engaging and Accessible

Contact MonsoonSIM:

Visit MonsoonSIM's contact us page for training or for advice on your class. Provide information regarding your occupation and the institution you represent. This information helps MonsoonSIM tailor the best experience and support for you!

Claim Your Trial Server:

Upon claiming the MonsoonSIM trial server, you will receive your own server with your institution’s branding. This is your gateway to introducing experiential learning into your curriculum.

Visit our Trial page to explore firsthand how MonsoonSIM can transform your teaching or training environment. This trial invites educators and business professionals to engage with our comprehensive business simulation platform, enabling you to integrate practical, hands-on business management and ERP scenarios into your curriculum. Experience the effectiveness of learning through simulation and see the real-time benefits it can bring to your educational strategies.

Start your journey by booking your free trial today.

Interested in integrating MonsoonSIM into your learning or training program? Learn how to make the most of its capabilities for enhancing financial literacy with "Teach Smarter, Utilize MonsoonSIM's Free Trial Server for Effective eLearning"

Just Want to Keep up? Follow our newsletter

Familiarize Yourself with MonsoonSIM:

If this is your first time on the MonsoonSIM teaching platform, worry not! MonsoonSIM provides a simple guide with pictures and easy-to-follow instructions to help you start running the simulation with your students.

Run Trial Games:

The trial server allows you to run 20 games upon activation. Utilize this opportunity to familiarize both yourself and your students with the simulation, and to explore the various features and functionalities MonsoonSIM offers.

After the implementation, evaluate the outcomes, gather feedback from your students, and reflect on the learning experience. Consider any necessary adjustments to enhance the integration of MonsoonSIM in future courses.

Teach MonsoonSIM with Accounting

| The world of accounting goes beyond textbooks; it's about applying what's learned in a real, practical setting. | There’s a projected 4% growth in jobs for accountants and auditors from 2022 to 2032, indicating that practical skills are in demand. |

| MonsoonSIM offers an interactive accounting business simulation that bridges the gap between theory and practice. | MonsoonSIM aligns its simulations with GAAP (Generally Accepted Accounting Practice), ensuring consistency and transparency in financial statements. |

Navigating Financial Literacy with MonsoonSIM

The article emphasizes the importance of practical, hands-on experience in the world of accounting, which is equally essential as theoretical knowledge. MonsoonSIM offers an interactive accounting business simulation that bridges this gap, making learning both engaging and relevant for aspiring accountants. The platform provides in-depth exploration modules like money management, accounting methods, financial reports, and integrated reporting.

See how Michigan State University has seamlessly woven MonsoonSIM into their undergraduate and graduate accounting programs, spurring engagement and enhancing the educational journey.

Key highlights include:

- Bridging Theory and Practice: MonsoonSIM translates theoretical accounting concepts into real-world applications, ensuring students not only understand the theoretical underpinnings of accounting but also apply them in business scenarios.

- Intermediate Takeaways: The platform provides features like a bank overdraft facility and loan management, aiding in financial crisis management. Additionally, its Business Intelligence module customizes learning experiences, emphasizing financial performance analysis.

- Hands-On Experience: MonsoonSIM offers a practical approach where users can record transactions, maintain balance sheets, and generate profit and loss statements, ensuring real-world financial management readiness.

- GAAP-Rooted Financial Reporting: The platform aligns its simulations with GAAP (Generally Accepted Accounting Practice), ensuring consistency and transparency in financial statements. This equips students with both report generation and analytical skills, allowing them to interpret financial data effectively.

- Testimonials: Many have noted the effectiveness of MonsoonSIM in enhancing student engagement and comprehension, highlighting its ability to immerse users in realistic business scenarios.

- Getting Started: The article provides a guide for educators to integrate MonsoonSIM into their curricula, starting from aligning the simulation with course objectives to signing up for a MonsoonSIM Server Trial.

In essence, MonsoonSIM offers a transformative learning experience that transcends traditional accounting education, preparing students for real-world challenges in the ever-evolving field of accounting and finance.

MonsoonSIM translates theoretical accounting concepts into real-world applications, ensuring students not only understand the theoretical underpinnings of accounting but also apply them in business scenarios.

Frequently Asked Questions:

Q: How does MonsoonSIM contribute to developing leadership skills?

A: MonsoonSIM offers modules that emphasize strategic decision-making and team management, crucial for honing leadership abilities. For a deeper understanding, see "Cultivating Next Generation Leaders with MonsoonSIM."

Explore the comprehensive simulation experience of financial management with our Finance (FIN) Module article, offering insights into money management, accounting practices, and financial analysis within a business context.

Q: Can MonsoonSIM be used to teach entrepreneurship effectively?

A: Yes, MonsoonSIM's simulation covers critical entrepreneurial skills like market analysis and risk management. Explore more in "Teaching Entrepreneurship Effectively with MonsoonSIM."

Q: Does MonsoonSIM support team collaboration in a corporate setting?

A: MonsoonSIM's gamified approach promotes teamwork, essential in corporate environments. Learn about its impact in "Enhancing Team Collaboration with MonsoonSIM Gamification in Corporate Training."

Q: How does MonsoonSIM facilitate practical learning in business education?

A: MonsoonSIM's experiential learning model allows students to apply theoretical knowledge in simulated business scenarios. For more details, visit "Business Experiential Learning with MonsoonSIM."